BACK TO PROJECTS

Design for a new app that brings all your banking into one place, linked to a single card used to access all your accounts.

Most people have multiple bank accounts along with the associated cards, which makes sense since they all offer different benefits. The best interest rates. No charges for using it while abroad.

Along with the multiple accounts and cards, comes the separate app for each bank. This all seems overly complex and unnecessary as society moves towards a contactless (sometimes cardless) society.

How can we reduce the amount of unused plastic cluttering our wallets and purses and simplify the management of our money?

One card, one app. The solution is to provide a single card that is not associated with a single bank but instead has the ability to be used for any current account, savings account or as a credit card. While the ideal solution would be to move purely to a contactless, mobile payment society, physical cards still play an important role especially when travelling/living in countries that don’t support contactless or even card payments.

This single card works in partnership with one app that gives complete control over the card and offers an overview of your banking all in one place. The Unum app not only allows you to change which card is linked to your Unum card but manage and understand your overall finances as well as offering new features not possible with the traditional bank card.

With a need to reduce the use of finite resources, simply having one card would help to contribute to a reduction in global plastic usage. There also lies space to innovate and produce a new type of card manufactured using alternative materials, not only more sustainable but longer lasting than the currently used ‘disposable’ plastic cards.

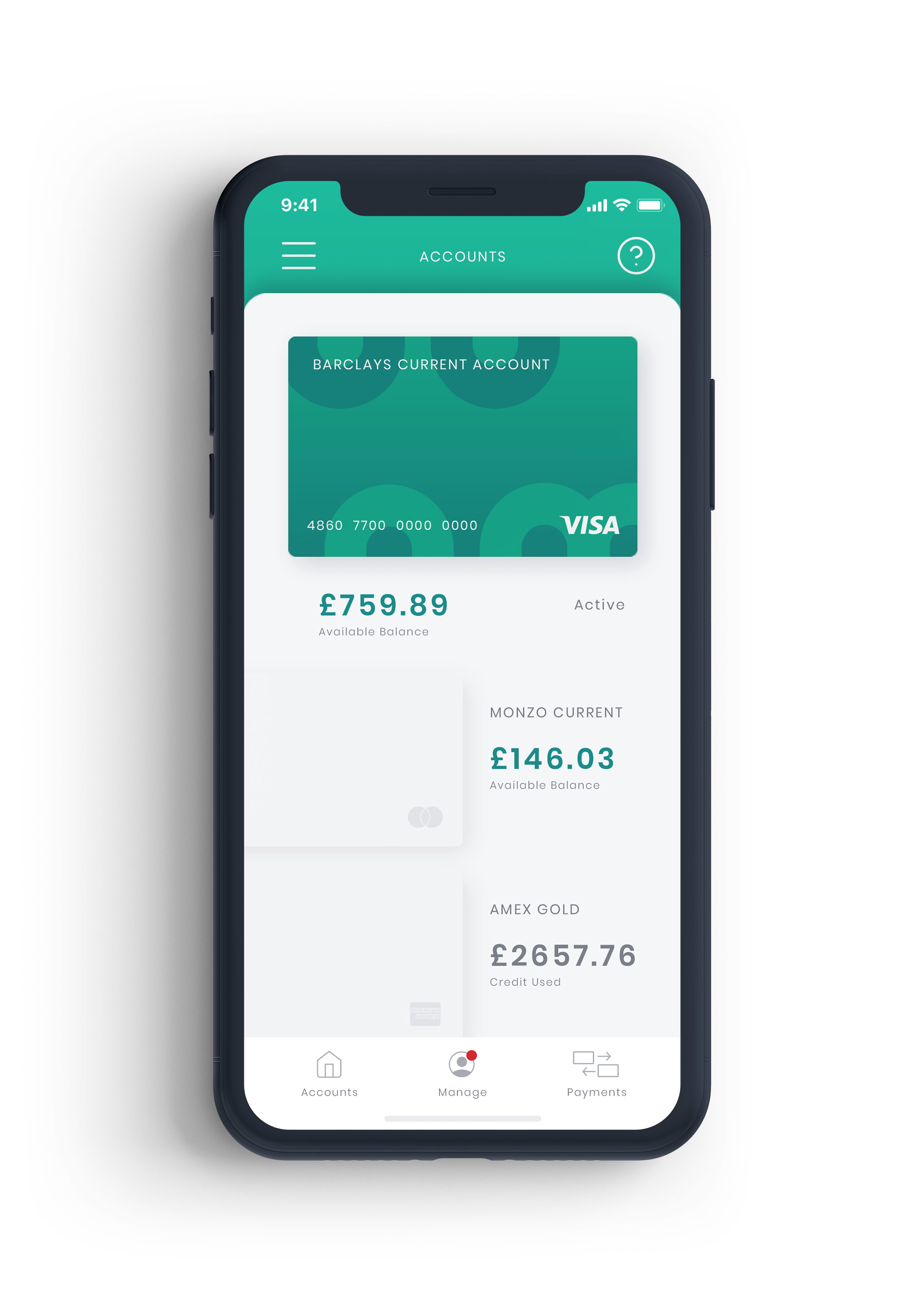

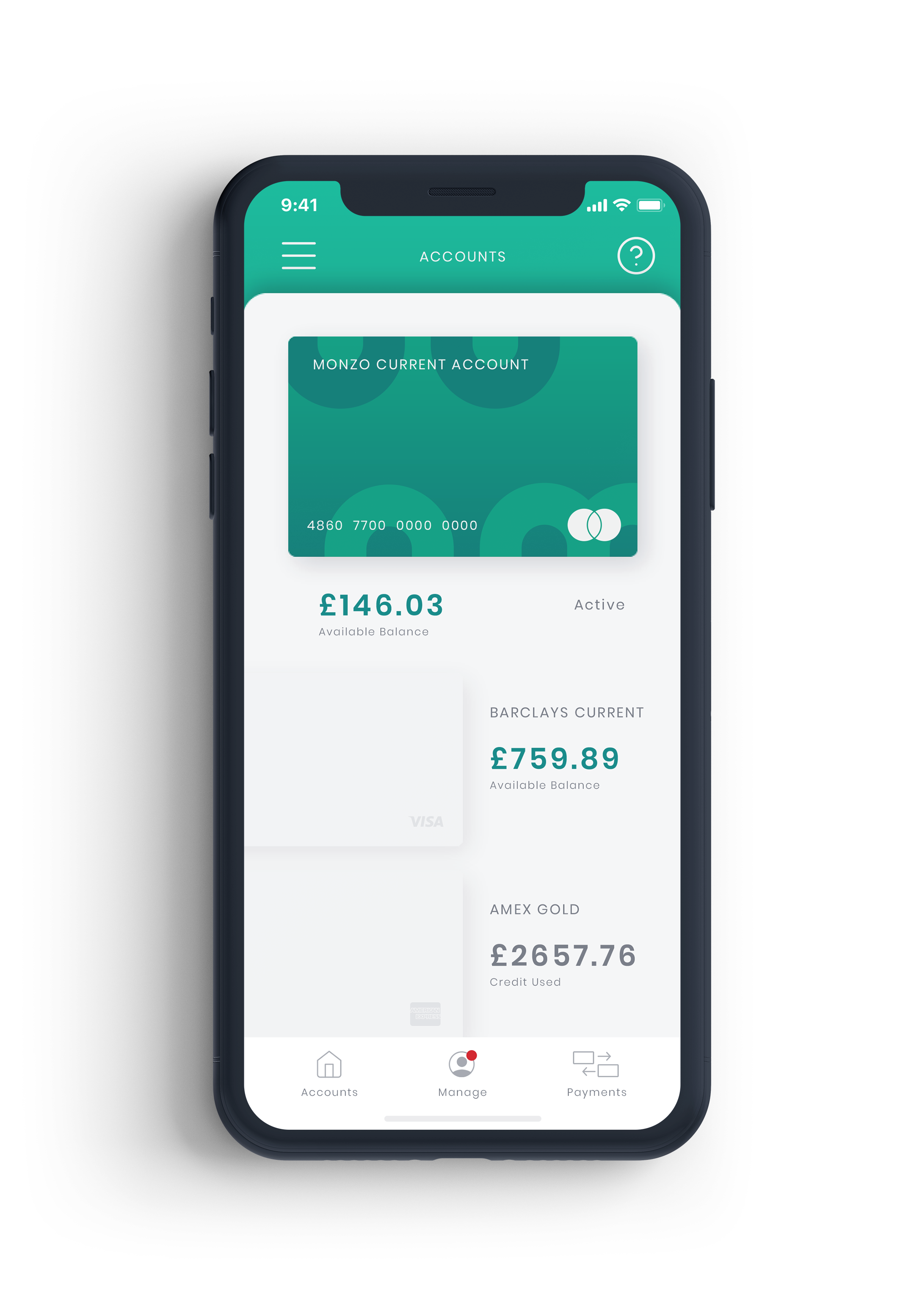

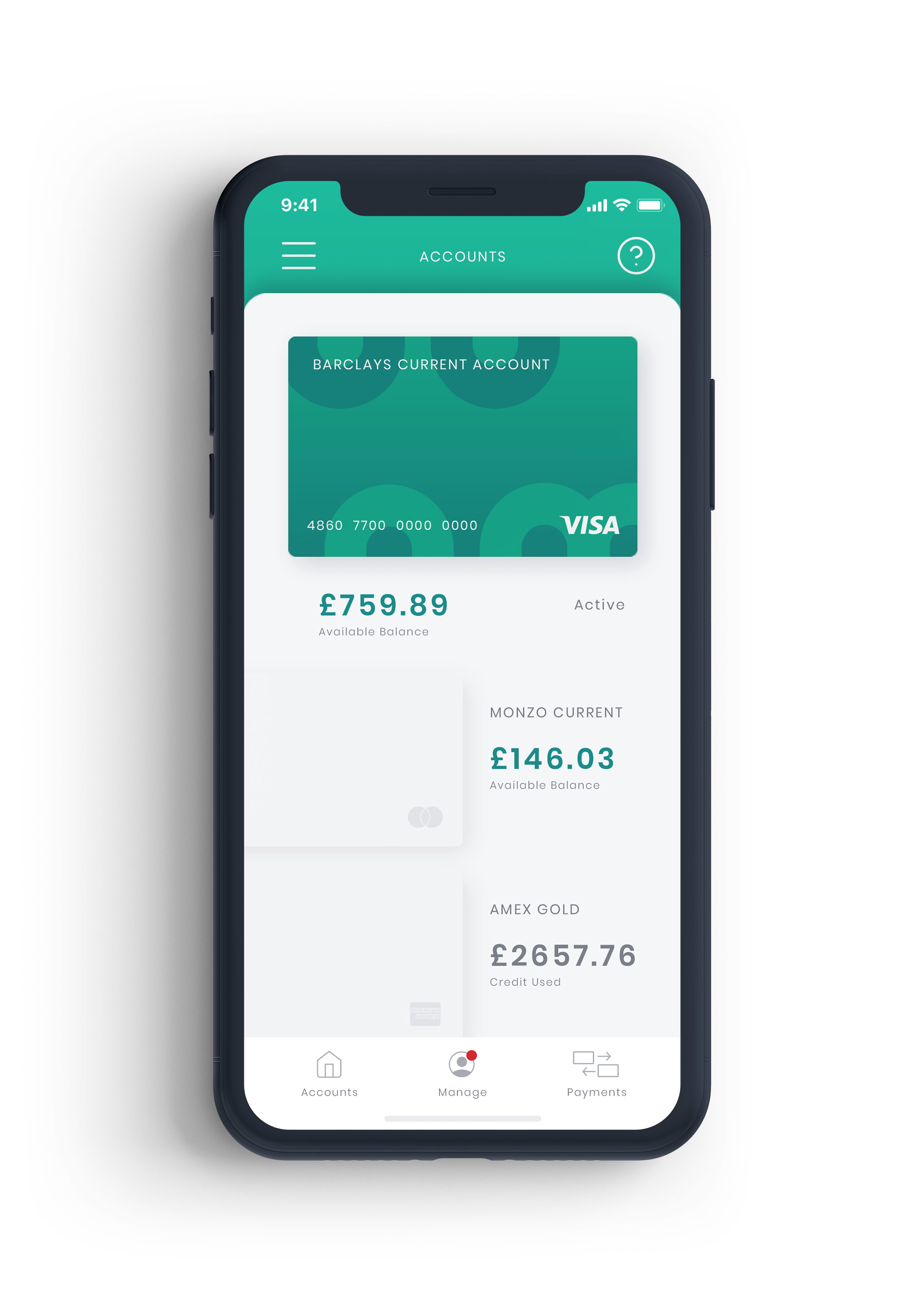

After logging in, the Unum app presents all your available accounts that you can use with your Unum card. From here you can easily understand which account is best to use, simply clicking on any account to see a full list of all recent transactions.

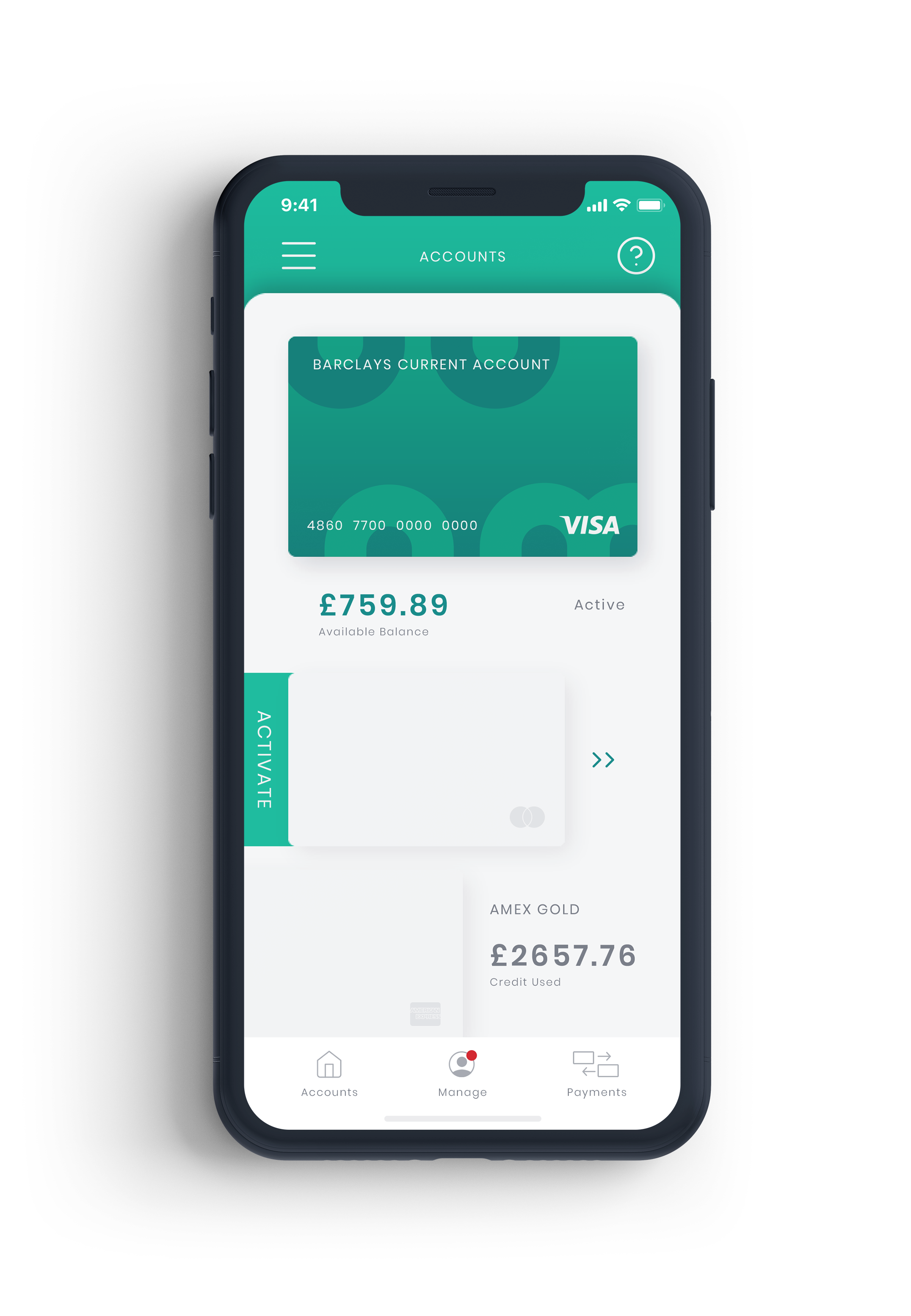

The account that is currently active on your card is displayed at the top of your account list. To change which account is linked to your card you simply double swipe on the chosen account.

This motion was chosen due to its ability to keep the account list’s design minimal and clear but also due to its familiarity from apps like iOS Mail.

.png)

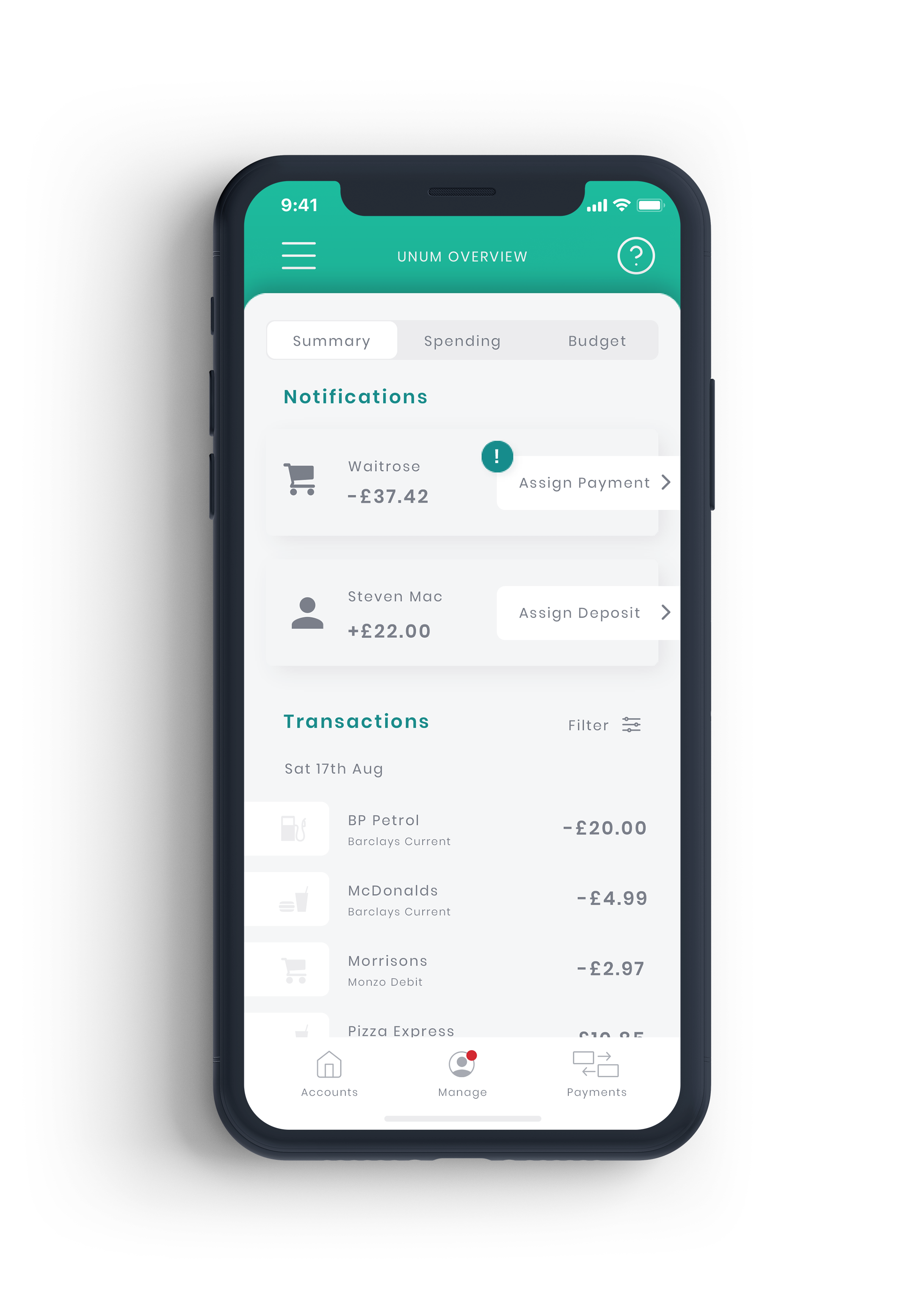

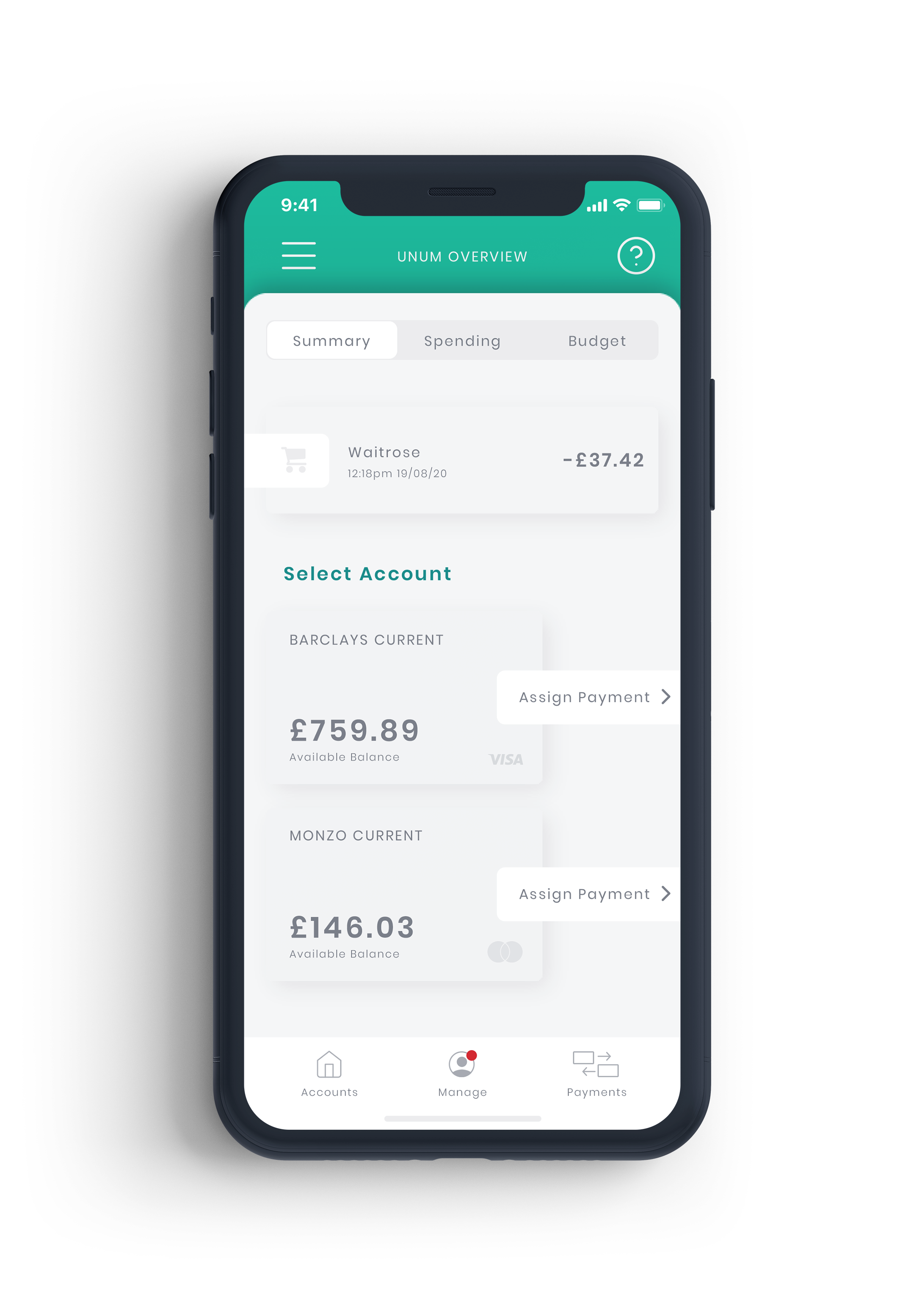

If you are unable to switch accounts and you attempt a purchase beyond available funds, due to Unum’s ability to understand your overall financial position, the payment can still be processed. Later on, you can then easily assign this payment to whichever account suits you best!

Unless you have a single account that you use for everything, it’s easy to have a big night out but put it on a different card so it doesn’t affect your monthly budget. However, since Unum has access to all your spending, it can create accurate spending and budget reports.

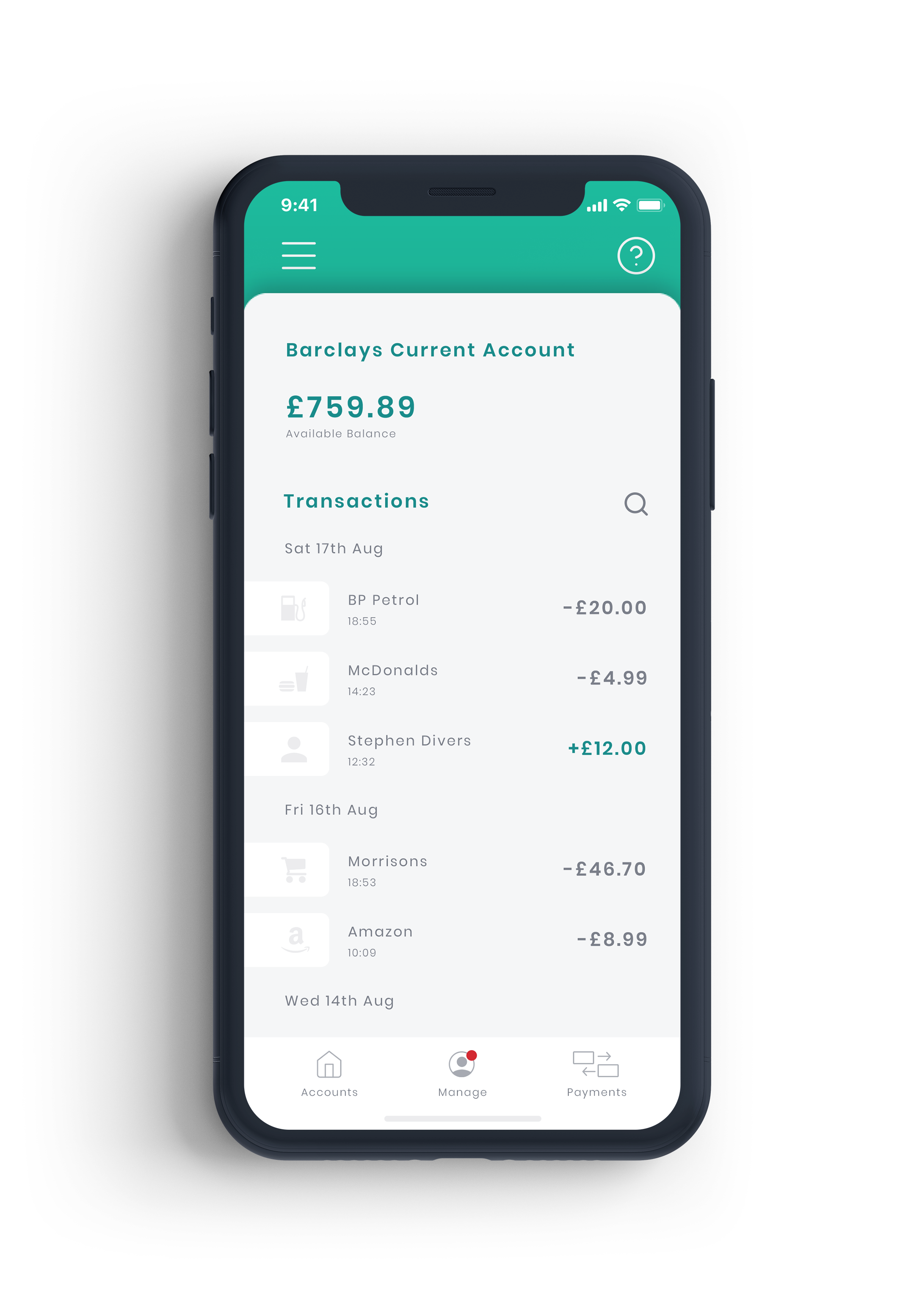

Simply click on any account for a list of the recent transactions using that account with your Unum card.

If you are unable to switch accounts and you attempt a purchase beyond available funds, due to Unum’s ability to understand your overall financial position, the payment can still be processed. Later on, you can then easily assign this payment to whichever account suits you best!

Unless you have a single account that you use for everything, it’s easy to have a big night out but put it on a different card so it doesn’t affect your monthly budget. However, since Unum has access to all your spending, it can create accurate spending and budget reports.

Simply click on any account for a list of the recent transactions using that account with your Unum card.

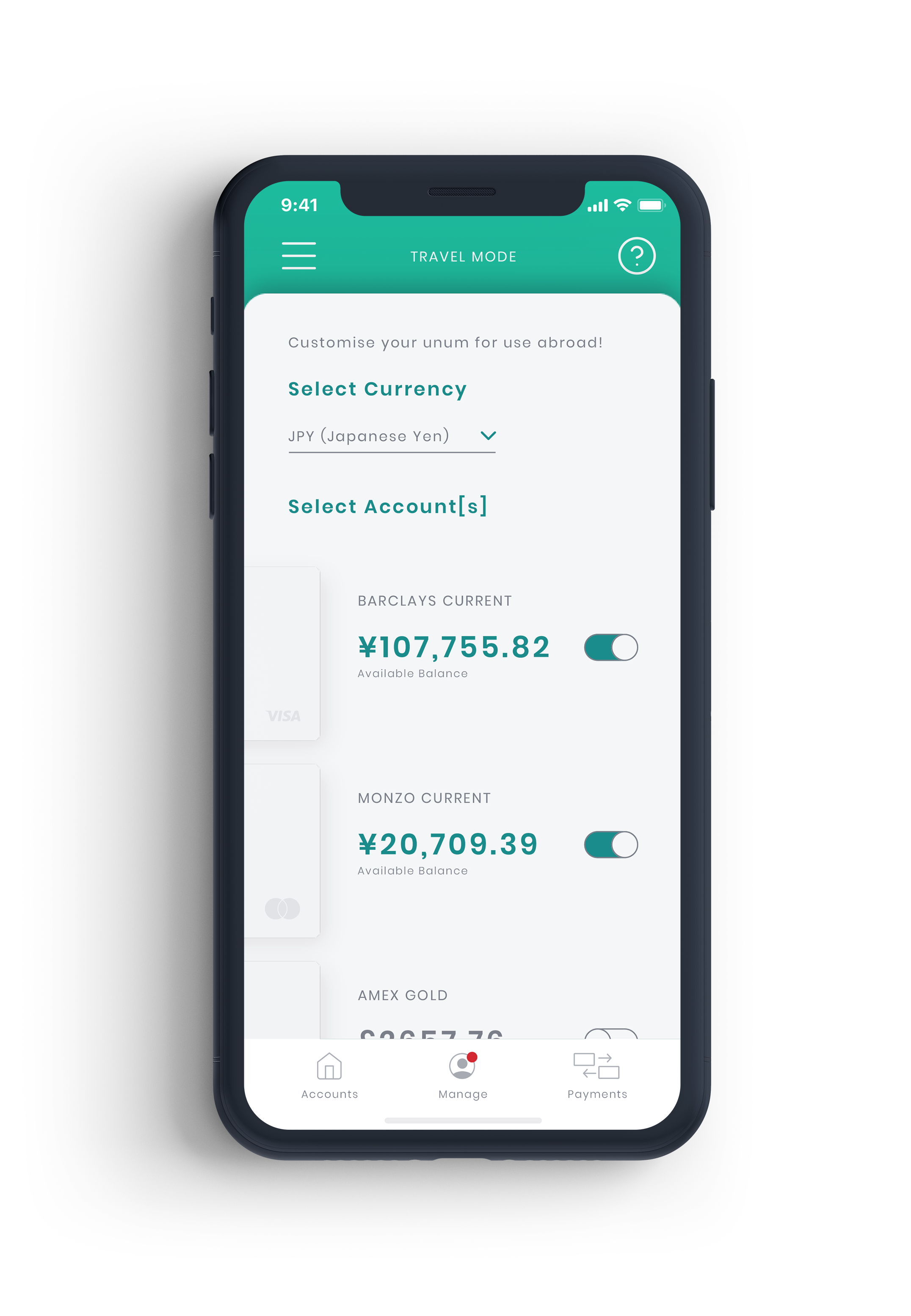

Since Unum is ideal to use while travelling, you can also choose which currency you would like your account to be displayed in. This doesn’t convert your account balance but helps you understand how much value your balance has in that country.